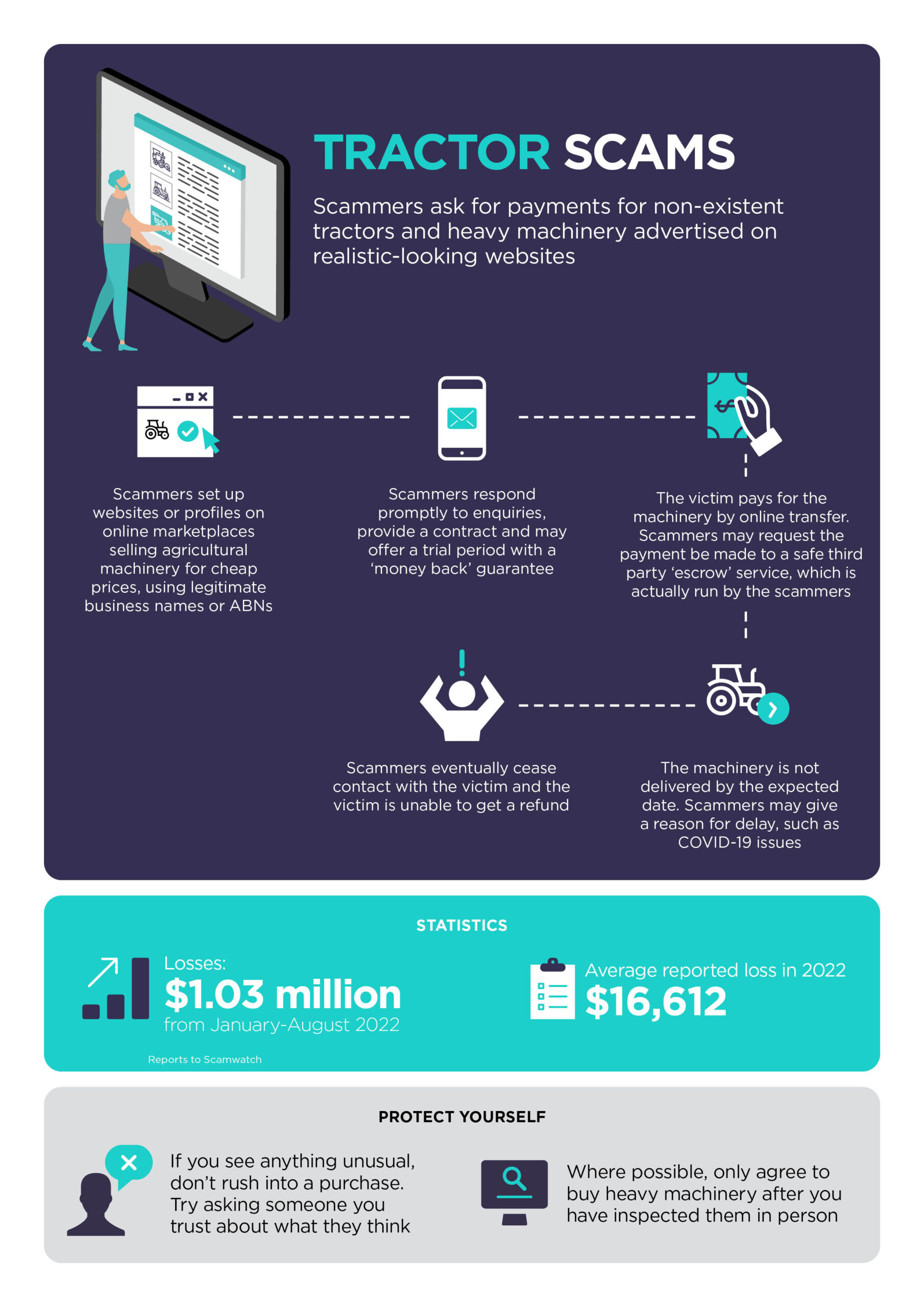

Australian farmers and agri-businesses are the targets of tractor scams.

Between January 2021 and August 2022, the ACCC’s Scamwatch has received 533 reports about tractor and heavy machinery scams, including total losses of $2.6 million.

These scams were for new tractors, with scammers creating fake websites, and for second-hand sales on marketplace websites such as Facebook and Gumtree.

How tractor scams work

Fake tractor website scams

Scammers create fake websites that look like genuine online shops selling agricultural machinery. They may use sophisticated designs and layouts, photos and brand logos taken from other websites, a ‘.com.au’ domain name and even an Australian Business Number (ABN) taken from a legitimate business. The websites often have a physical business address listed on the website which are vacant blocks or belong to another business.

Second-hand tractor scams

Scammers will pose as genuine sellers and post fake ads on classifieds websites, in print classifieds, and on online platforms such as Gumtree and Facebook Marketplace. However, once a deposit is paid, the scammer usually ‘disappears’ and delivery is never made.

7 tips to avoid being scammed

- If it seems too good to be true, it probably is

Scammers advertise machinery at much lower prices than what the market rate is. - Don’t purchase machinery if you haven’t seen it in person

Scammers will always come up with an excuse as to why you can’t inspect the machinery in person, or they will ask for a deposit first. - Beware if they offer a ‘free trial’ or an ‘escrow’ service

Scammers may offer a ‘free trial’ in an attempt to earn your trust. However, they would ask for a deposit to be paid first. Scammers may also reassure customers that the deposit is paid into a third party or ‘escrow’ account, but the ‘escrow’ service is also fake and part of the scam. - Don’t rush into a purchase

Be cautious if the seller tries to make the sale feel urgent. For example, scammers often say that they need to sell quickly because they are in the army and about to be deployed overseas, or that their father has passed away and they need to get rid of machinery from their parent’s farm. - Do your own research

Look for online reviews to see other people’s experience with the business. Do your research beyond the website itself, as those reviews may be fake.

Scammers may also steal other businesses’ names and ABN details for their website. If a physical address is listed, look it up online and see if it is the correct business on Google Maps. You could also call a neighbouring business to verify the seller. - Be careful what personal details and information you provide

Be careful if you are asked to provide a driver’s licence, passport or home address, which may be used for identity theft. Where people reported losses as a result of a scam, more than half of them lost personal details. - Speak to someone you trust

If you think the sale might be a scam, get a second opinion from a family member or a friend to see what they think.

Report a scam

We encourage you to report scams to the ACCC via the report a scam page. This helps the ACCC to warn people about current scams, monitor trends and disrupt scams where possible. Please include details of the scam contact you received, for example, email or screenshot.

Scamwatch also provides guidance on protecting yourself from scams and where to get help.

Fake invoices

Agri-businesses may be unknowingly paying fake invoices

Did you know that scammers sometimes send invoices that appear to be from real business suppliers, and you could pay them, not realising they are fake invoices until sometime later?

These are known as ‘fake invoice scams’ and between January and August 2022, the ACCC’s Scamwatch received 19 reports from farmers and agricultural businesses, with $320,572 in reported losses. Overall, over the same period, Australians lost $15,006,570 to fake invoice scams.

The scammers may hack into the email account of a business or supplier, and send you an email saying that their bank details have changed. These scammers can make invoices look almost identical to the real ones, with the only difference being the bank account details.

In one instance, a farmer paid a scammer’s fake invoice of over $60,000, as they believed they were paying an invoice for the purchase of machinery.

Protect yourself. What can you do to avoid being scammed?

- Be careful if a business tells you they have updated their bank details

If you receive an email containing an invoice that says the supplier’s bank details have been updated, you should call them to confirm this. Do not call the phone number on the invoice, as this may have been changed by the scammers. Instead, find the supplier’s phone number from another source. - You should also confirm via a phone call that you have the right bank details, if it is the first time you are paying money to that supplier’s account, or for large purchases.

We encourage you to report scams to the ACCC via the report a scam page. This helps the ACCC to warn people about current scams, monitor trends and disrupt scams where possible. Please include details of the scam contact you received, for example, email or screenshot.

Scamwatch also provides guidance on protecting yourself from scams and where to get help.

Dating

Look out for the red flags of a romance scam

Over several months, scammers can build what feels like the romance of a lifetime. Attracting their targets with a fake online dating profile, they ‘love-bomb’ their targets with loving words, sharing ‘personal information’ and even by sending gifts.

Once they have gained your trust, they will usually find reasons to ask you for money, gifts or your banking or credit card details. For example, the scammer may claim they want to travel to visit you, but cannot afford it unless you are able to lend them money to cover flights or other travel expenses.

They may also ask you to send pictures or videos of yourself, possibly of an intimate nature.

Protect yourself:

- Never send money or personal photos to someone you haven’t met before in person.

- Do an image search of your admirer to help determine if they really are who they say they are. You can simply copy and paste their photos into image search services such as Google or TinEye.

Be alert to things like spelling and grammar mistakes, inconsistencies in their stories and other signs that it’s a scam, such as their camera never working when you want to videocall.

Report the scam:

We encourage you to report scams to the ACCC via the report a scam page. This helps the ACCC to warn people about current scams, monitor trends and disrupt scams where possible. Please include details of the scam contact you received, for example, email or screenshot.

Scamwatch also provides guidance on protecting yourself from scams and where to get help.

General scams awareness

Protect yourself from scammers by being scam aware

Between January and August 2022, Australian farmers and agricultural businesses lost over $1.2 million to scammers. In total, Australians have lost over $300 million to scammers so far this year.

It can be difficult to recover any losses suffered from a scam and so it is important to stop them before they happen. The best way to do this is to report and raise awareness about scams, including common types of scams and what to look out for, to prevent more Australians from getting scammed.

The ACCC operates Scamwatch, which aims to help Australian consumers and small businesses recognise scams and avoid them by providing information about how to report scams and where to get help if they’ve been scammed.

Two common types of scams to look out for

Phishing scams

Phishing scams are attempts by scammers to trick you into giving out personal information such as bank account numbers, passwords, credit card details or personal information.

A scammer may contact you by email, phone call or text message and pretend to be from a legitimate business such as a bank or internet service provider. For example, they may pose as a bank seeking to ‘verify’ customer records.

To protect yourself from phishing scams, do not click any links or attachments in an email unless you are certain it is from a trusted organisation. If the email asks you to update or verify your details, this should be a warning sign.

Do an internet search using the names or exact wording of the email or message to check for any references to a scam. Many common scams can be identified in this way.

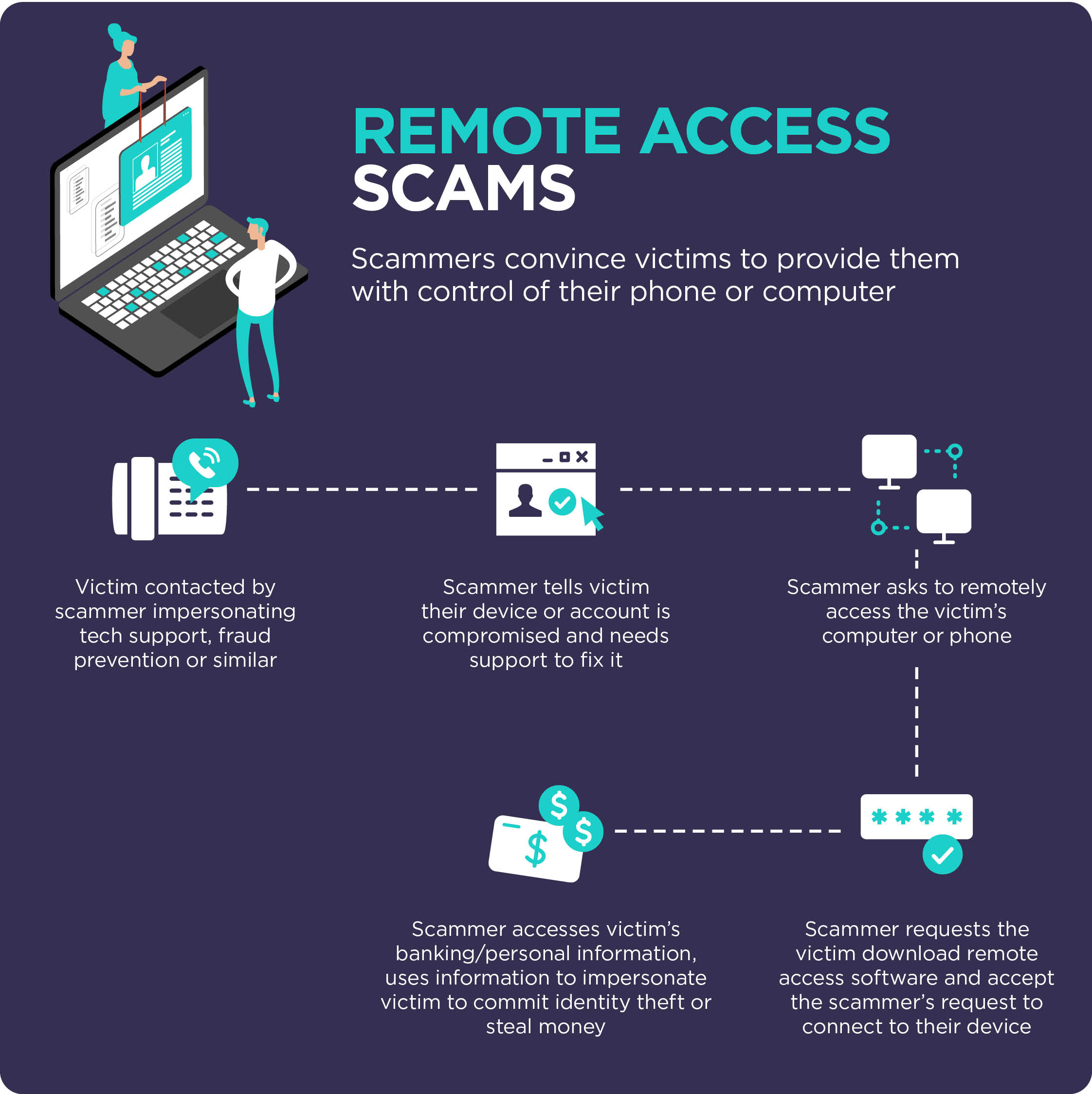

Remote access scams

A remote access scam happens when a scammer gets access to your computer after convincing you to download software to fix an internet or computer problem.

The scammer will usually phone you, pretending to be a from a large telecommunications or computer company such as Telstra, the NBN or Microsoft. They may also claim to be a technical support service provider.

Once they have remote access, scammers can access personal information stored on your computer, install malicious software or use your information for other crimes, such as identity theft.

To protect yourself from remote access scams, never give an unsolicited caller remote access to your computer. You should also never give your personal, credit card or online account details over the phone unless you made the call and the phone number came from a trusted source.

Find out more about scams

You can read more about these scams and other common scams on the ACCC’s Scamwatch page. Scamwatch also provides guidance on protecting yourself from scams and where to get help.